B2B cooperations

How MAIESTAS AG sets new standards in asset management

Published: 10.06.2021 | By investify

Cologne-based MAIESTAS, founded around owner Petra Ahrens, who was newly elected to the VuV board, is taking a promising new approach to its asset management. In its reorientation, the company relies on the investify TECH platform, which focuses on simple and digital processes for customers and managers.

Going digital and strengthening personal consulting

True digitization that saves costs and enables new customer experiences can only succeed if it takes place end-to-end. With different systems, software providers and non-digitized custodians, on the other hand, this goal is difficult to achieve because a flood of different applications has to be managed. For this reason, MAIESTAS has deliberately opted for a complete solution. The investify TECH platform brings the entire spectrum of asset management from a single source: Digital onboarding, automated portfolio opening, high-quality portfolio management system, particularly appealing quarterly reports, and customer and advisor portals including an app.

The advantage of the complete solution: internal process and back-office costs can be reduced to almost zero and implementation works simply by plug-and-play. At the center are portfolios developed by MAIESTAS. There is no restriction on asset classes, so in addition to the classic strategies there will also be a special track just for precious metals.

Minimize regulatory burden and back-office operations

With the platform, asset managers of all sizes can work particularly efficiently and focus on their core competencies such as personal contact with clients, sales and asset management. The special feature: as a regulated portfolio manager, investify TECH can also handle a number of regulated processes for the asset manager, which includes the following features:

- Monitoring of investment guidelines

- Monitoring of the loss thresholds

- Monitoring of the portfolio structure

- Preparation of the entire reporting (quarter, costs)

- Ordering and order controls

- Handling of payment processes

- Settlement processes of customer fees.

This approach also means that there is no need for coordination with a custodian bank in this model – so it is not surprising that more and more asset managers are opting for complete solutions of this kind. In addition to the obvious simplifications in day-to-day work, there is a significant long-term advantage: If the regulations change, the platform takes care of the implementation. The asset manager is always on the safe side from a regulatory point of view without burdening his own capacities.

Connect more sales units and grow

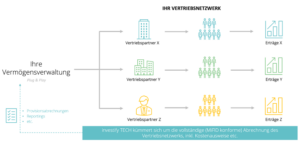

In addition to the high level of technological and regulatory expertise, a decisive factor in the selection of investify TECH was that distribution networks such as broker pools and intermediaries that distribute asset management could also be easily connected. MAIESTAS is already working with three pools. The advantage: in the future, investify TECH will also take over the billing of the feeders. MAIESTAS can thus scale its asset management in-house and in third-party distribution without additional costs and open up new growth areas.

In the age of the zero interest policy and the death of branch banks, MAIESTAS sees enormous potential from investors looking for active asset management, even for smaller assets. The already existing cooperations with financial distributors show an increased demand for active management by a financial professional and offer the serious alternative to the classically managed fund deposit.

Digitalization and automation are already changing the future of work in many industries. Automated regulatory work will be an important milestone for the asset management industry. Time-consuming tasks will be replaced, giving employees the chance to spend more time on their core activities and thus gain an important competitive advantage.

Reports on our new cooperation include: